Operating within Kenya's fluctuating economic climate presents businesses with various challenges, including inflationary pressures, variable currency exchange rates, and evolving market conditions that can jeopardize financial stability. To navigate these complexities successfully, businesses require effective budgeting and forecasting tools. Odoo Finance delivers a robust solution designed specifically for these challenges, allowing Kenyan companies to manage their financial planning with greater accuracy and responsiveness to economic changes.

In this post, we will examine how Odoo Finance can support Kenyan businesses in addressing the unique economic challenges they face through enhanced budgeting and forecasting capabilities.

Budget Management Features for a Fluctuating Economic Environment

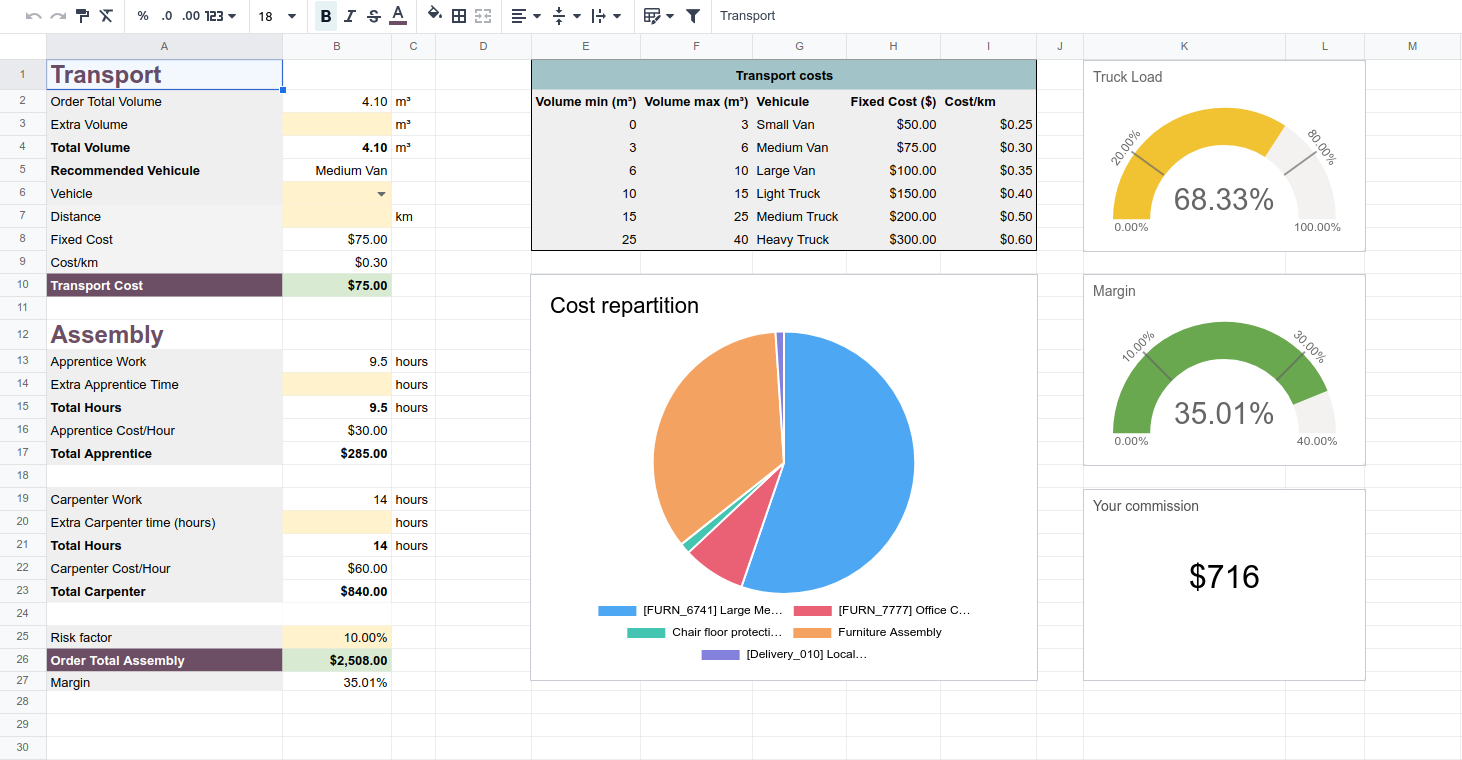

Budgeting is crucial for businesses in Kenya, where inflation rates and currency fluctuations can impact operational costs. Odoo Finance simplifies the budgeting process by allowing businesses to create, monitor, and adjust budgets in real time. Kenyan businesses can easily track expenses, compare them against their budgets, and adjust allocations based on actual performance.

For example, businesses can set departmental budgets or budgets for specific projects, and Odoo will automatically monitor expenditures against these budgets. This allows Kenyan companies to stay on top of their financial goals, making sure they don’t exceed spending limits even in volatile economic conditions. With the ability to automatically adjust budgets as market conditions shift, businesses are better prepared to handle unforeseen changes in the economy.

Accurate Financial Forecasting in the Face of Inflation

Kenya has experienced periods of high inflation, which can significantly affect business costs, pricing strategies, and purchasing power. Odoo Finance provides tools that help Kenyan businesses make accurate financial forecasts despite such challenges. By using historical data, market trends, and real-time financial information, businesses can forecast future revenue, expenses, and cash flow with more precision.

Odoo's AI-powered forecasting tools analyze historical financial data and provide businesses with projections based on trends in the economy. For example, businesses can forecast potential price increases for goods and services due to inflation and adjust their pricing strategies accordingly. Additionally, Odoo allows companies to simulate different economic scenarios, helping them prepare for various inflation rates or shifts in the cost of raw materials, allowing for better strategic planning.

Currency Exchange Adjustment Features

Kenyan businesses involved in import or export activities are highly susceptible to currency exchange rate fluctuations, which can affect profitability. Odoo Finance allows businesses to factor these fluctuations into their budgeting and forecasting processes.

With Odoo, Kenyan businesses can monitor foreign exchange rates in real time and adjust their budgets to reflect changes in the cost of imported goods or revenue from exports. For instance, if the Kenyan shilling depreciates, businesses can adjust their forecasts to account for higher import costs or reduced profit margins on exports. Odoo’s multi-currency support also enables businesses to manage their finances across different currencies, providing a more comprehensive view of how exchange rate changes impact overall financial health.

Leveraging Local Market Trends for Forecasting

Understanding local market trends is essential for accurate financial forecasting in Kenya. Odoo Finance provides detailed analytics that help businesses track consumer behavior, purchasing patterns, and industry trends. By analyzing this data, businesses can forecast demand for products or services and adjust their budgets accordingly.

For example, a retail business in Kenya may notice an increase in demand for certain products during specific seasons or economic cycles. Using Odoo's forecasting tools, the business can project sales growth during these periods and allocate more resources to inventory or marketing to capitalize on the opportunity. Odoo's integrated reporting tools make it easy to track these trends and adjust financial forecasts based on real-time data, ensuring businesses are always prepared to meet market demands.

Data-Driven Decision Making for Kenyan Businesses

In Kenya’s unpredictable economic landscape, data-driven decision making is crucial for long-term success. Odoo Finance empowers businesses to make informed decisions by providing access to real-time financial data. Business owners and managers can use Odoo’s customizable dashboards to monitor financial performance, compare actual results against forecasts, and adjust their strategies accordingly.

By combining budgeting, forecasting, and financial analysis, Odoo helps Kenyan businesses maintain financial stability and growth, even in challenging economic environments. The platform’s ability to automate routine financial tasks also frees up time for decision-makers to focus on strategic planning and responding to market changes.

Proactive Financial Risk Management Solutions

Kenyan businesses face various risks, including economic instability, regulatory changes, and fluctuating commodity prices. Odoo Finance helps businesses mitigate these risks by providing tools for proactive financial planning. By using Odoo’s risk management features, businesses can identify potential financial risks early and take steps to mitigate them before they impact the bottom line.

For instance, a manufacturing business can use Odoo to track fluctuations in the cost of raw materials and adjust its procurement strategy to lock in lower prices or find alternative suppliers. This type of proactive financial management helps Kenyan businesses reduce uncertainty and protect their profit margins in volatile economic conditions.

Conclusion: Odoo Finance for Smarter Budgeting and Forecasting in Kenya

Kenyan businesses need robust tools to navigate the country’s complex economic environment. Odoo Finance provides a comprehensive solution for budgeting and financial forecasting, helping businesses manage their finances more effectively in the face of inflation, currency fluctuations, and changing market trends.

By using Odoo’s advanced tools for real-time budgeting, forecasting, and financial analysis, Kenyan businesses can make more informed decisions, stay financially agile, and achieve long-term growth.

Ready to future-proof your business finances? Blackpaw Innovations is here to help you implement Odoo Finance for smarter financial planning. Contact us today to learn more!