As the business environment in Kenya continues to evolve rapidly, companies are confronted with the challenge of effectively managing their finances while adhering to local tax laws. Whether they are small startups or established corporations, financial management is essential for fostering growth and ensuring sustainability. Odoo Finance, a component of the Odoo ERP suite, provides a robust financial management solution tailored to assist Kenyan businesses in optimizing their accounting processes, overseeing cash flow, and maintaining compliance with the regulations set forth by the Kenya Revenue Authority (KRA).

At Blackpaw Innovations, we specialize in implementing Odoo solutions tailored to the unique financial needs of businesses in Kenya. In this blog, we’ll explore the key features of Odoo Finance and how it can transform your financial management processes.

Simplified Digitized Financial Management Features for Kenyan Businesses

Odoo Finance is designed to simplify financial processes, from bookkeeping to tax reporting. Kenyan businesses can manage all their financial operations in one platform, reducing the need for multiple systems and minimizing manual errors.

With Odoo, businesses can manage accounts receivable and payable, monitor cash flow, and generate financial reports, all while staying compliant with KRA regulations. The intuitive user interface makes it easy for Kenyan business owners and accountants to navigate and control every aspect of their financial operations without the complexity found in traditional accounting software.

Compliance with Kenya Revenue Authority (KRA) Regulations

For Kenyan businesses, compliance with the KRA’s tax regulations is essential. Odoo Finance offers advanced tax management tools that cater specifically to the Kenyan business environment. The system supports Electronic Tax Invoice Management System (eTIMS) integration, allowing businesses to generate and file tax reports directly with the KRA.

Odoo automates tax calculations for VAT, withholding tax, and other local taxes, ensuring accuracy and reducing the risk of penalties due to manual errors. Businesses can generate audit-ready tax reports at the click of a button, making it easier to comply with KRA requirements and maintain proper financial records.

Streamlined Invoicing and Billing Features

Odoo Finance streamlines the invoicing and billing process, helping Kenyan businesses improve cash flow and reduce administrative burdens. The system provides customizable invoice templates that reflect your business’s brand identity, and allows for automatic generation of invoices based on sales orders or contracts.

Kenyan businesses can also take advantage of Odoo’s automated follow-up feature, which sends reminders to clients for overdue payments via email, SMS, or WhatsApp, ensuring timely collections and improved cash flow.

Automated Bank Reconciliation and Cash Flow Management

Tracking cash flow and reconciling bank accounts can be time-consuming, especially for businesses that deal with multiple transactions daily. Odoo Finance automates bank reconciliation by syncing directly with your bank, importing statements, and suggesting matches for 95% of transactions. For the remaining 5%, Odoo’s intuitive reconciliation tool ensures faster and more accurate processing, helping Kenyan businesses maintain up-to-date financial records.

Additionally, Odoo provides real-time cash flow management, giving Kenyan business owners clear visibility into their liquidity and allowing them to make informed decisions for business growth.

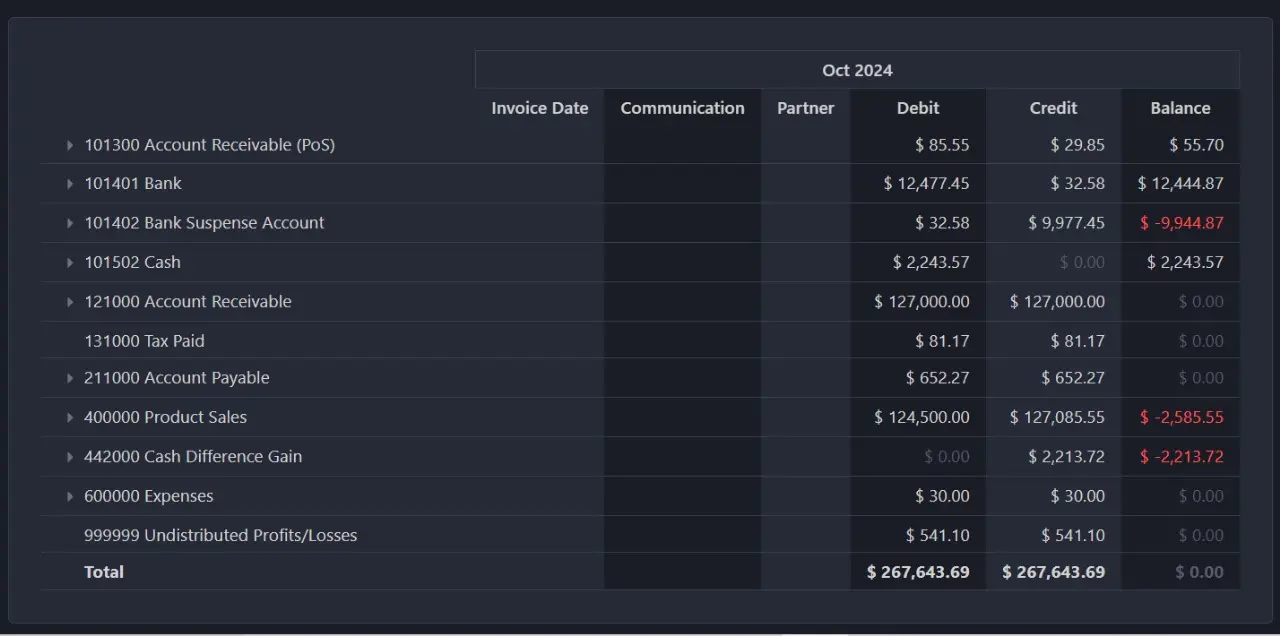

Powerful Financial Reporting and Analysis

Understanding your financial position is crucial for making strategic decisions. Odoo Finance offers robust financial reporting and analysis tools, enabling Kenyan businesses to generate comprehensive reports such as profit and loss statements, balance sheets, and cash flow statements.

With Odoo, you can create customized financial dashboards that track key metrics like revenue, expenses, and profitability, helping you stay on top of your business performance and make data-driven decisions.

Budgeting and Forecasting for Kenyan Businesses

Odoo Finance also helps Kenyan businesses manage their budgets and forecast their financial future accurately. Businesses can create and manage budgets for different departments or projects, track actual versus budgeted expenses, and adjust financial forecasts based on real-time data. This level of control allows Kenyan companies to optimize resource allocation, reduce overspending, and ensure financial stability.

Integration with Other Business Systems

Odoo Finance seamlessly integrates with other Odoo modules, such as CRM, sales, inventory, and human resources, providing Kenyan businesses with an all-in-one solution for managing their entire operations. This integration ensures that financial data flows smoothly across departments, reducing the need for manual data entry and minimizing errors.

At Blackpaw Innovations, we tailor Odoo solutions to meet the specific needs of Kenyan businesses, ensuring smooth workflows and enhancing operational efficiency.

Transform Your Financial Management with Odoo Finance

For Kenyan businesses looking to improve their financial management processes, Odoo Finance provides a complete solution that simplifies accounting, ensures tax compliance, and streamlines invoicing and reconciliation. Whether you're a small business or a growing enterprise, Odoo Finance offers the tools needed to manage finances effectively while meeting local regulatory requirements.

Ready to take control of your business finances? Contact Blackpaw Innovations today to learn how we can help you implement Odoo Finance and revolutionize your financial management.