Odoo Finance assists entrepreneurs in managing tax obligations and ensuring compliance with Kenyan regulations.

For businesses operating in Kenya, compliance with the tax regulations set forth by the Kenya Revenue Authority (KRA) is crucial for success. Various taxes, including VAT, withholding tax, PAYE, and corporate tax, demand careful management, as failure to comply can result in severe penalties, audits, or interruptions in business operations. Keeping track of these taxes while ensuring accurate record-keeping and timely filing can be particularly daunting for expanding enterprises.

Odoo Finance provides an all-encompassing solution designed to assist Kenyan businesses in optimizing their tax management practices, thereby ensuring adherence to KRA standards and enhancing the efficiency of tax reporting. In this article, we will delve into the essential tax management functionalities of Odoo Finance and how they empower businesses in Kenya to effectively manage their tax responsibilities.

Simplifying VAT Compliance with Odoo Finance

For businesses in Kenya, Value-Added Tax (VAT) is a key tax to manage, and compliance is crucial for avoiding penalties. Odoo Finance simplifies the management of VAT returns by automating the process of calculating VAT on sales and purchases.

Odoo's VAT module is designed to track the applicable VAT rate for each transaction and ensure that the correct amounts are charged on invoices. The system also allows businesses to generate VAT reports, showing both input VAT (paid on purchases) and output VAT (collected on sales), which can then be submitted to the KRA via iTax. This ensures accurate reporting and helps businesses claim VAT refunds when applicable.

In addition, Odoo can be configured to handle VAT exemptions and zero-rated items, providing flexibility for businesses that deal with specific products or services that qualify for VAT relief.

Withholding Tax Management Solutions

Kenyan businesses are required to deduct and remit withholding tax on certain payments, such as professional services, interest, and rent. This requires diligent tracking of payments and the correct application of withholding tax rates to avoid underpayments or overpayments to the KRA.

Odoo Finance makes withholding tax management simple by automatically calculating the correct withholding tax rates on qualifying transactions. The system generates detailed reports showing the amounts withheld, making it easy for businesses to file their withholding tax returns on time.

Additionally, Odoo's tax management features include withholding certificates, which are issued to suppliers and service providers for tax purposes, ensuring that both parties are compliant with KRA requirements.

PAYE and Payroll Management Solution

In addition to VAT and withholding tax, businesses in Kenya must comply with Pay As You Earn (PAYE) regulations for their employees. Managing PAYE can be complex, especially when factoring in various allowances, deductions, and tax brackets.

Odoo Finance integrates seamlessly with payroll management, ensuring that PAYE is calculated accurately for each employee based on their gross salary and taxable benefits. The system automatically applies the correct tax rates and thresholds, making it easy for businesses to generate accurate PAYE returns and file them through iTax.

Odoo also supports other statutory deductions required by law, such as the National Social Security Fund (NSSF) and National Hospital Insurance Fund (NHIF) contributions, ensuring full compliance with payroll tax obligations.

Managing Corporate Tax and Filing with iTax

Kenyan businesses are required to pay corporate income tax on their profits. Odoo Finance simplifies the management of corporate tax by providing tools to track business income and allowable expenses, ensuring that taxable profits are accurately calculated.

The system automatically applies the correct corporate tax rates based on the business’s tax classification (e.g., standard corporation tax, turnover tax for small businesses) and generates detailed corporate tax reports. These reports can be used to file corporate tax returns directly through iTax, streamlining the filing process and reducing the risk of errors.

By providing a clear view of a business’s tax liabilities, Odoo Finance helps businesses plan their tax payments and avoid penalties for underreporting or late filing.

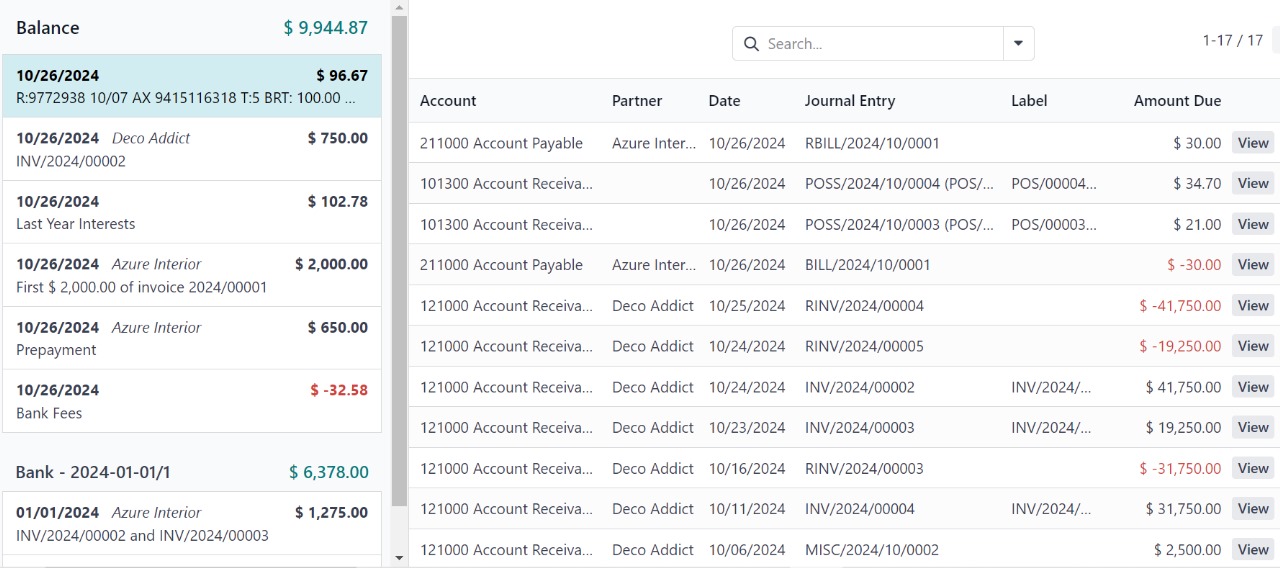

Accurate Tax Reporting System

One of the standout features of Odoo Finance is its ability to generate accurate and detailed tax reports that are compliant with Kenyan regulations. Whether it's VAT, withholding tax, PAYE, or corporate tax, Odoo provides the reports needed to ensure timely and accurate filing.

These tax reports are designed to meet KRA's iTax requirements, making it easy for businesses to upload their returns directly to the system. This automation reduces manual data entry, minimizes the risk of errors, and ensures that businesses remain compliant with the KRA’s tax filing deadlines.

Ensuring Compliance with KRA Tax Audits

Tax audits by the Kenya Revenue Authority are a reality for many businesses, and having proper documentation and accurate financial records is crucial for passing these audits. Odoo Finance offers a comprehensive audit trail, ensuring that all transactions related to tax are well-documented and can be easily retrieved during an audit.

With Odoo, Kenyan businesses can maintain detailed records of sales, purchases, employee payroll, and supplier payments, providing full transparency into their financial operations. This audit trail not only helps businesses comply with KRA audits but also provides valuable insights for internal audits and financial analysis.

Streamline Your Tax Compliance with Odoo Finance

Odoo Finance is a powerful tool for Kenyan businesses looking to streamline their tax management and ensure compliance with KRA regulations. Whether it’s handling VAT, withholding tax, PAYE, or corporate tax, Odoo simplifies the entire tax process, from calculation to filing through iTax.

By automating tax processes and providing accurate reports, Odoo helps businesses avoid penalties, reduce manual errors, and ensure that their tax obligations are met efficiently.

If you’re ready to take the next step in managing your business taxes, Blackpaw Innovations can help you implement Odoo Finance tailored to your needs. Contact us today to find out how we can help your business stay compliant with Kenyan tax regulations.