Odoo Finance for Managing Accounts Receivable and Payable in Kenya empowers entrepreneurs to efficiently track their company's finances.

Managing accounts receivable (AR) and accounts payable (AP) is crucial for Kenyan businesses looking to optimize their cash flow, manage debt collection, and handle supplier payments effectively. The complexities of these tasks, especially in a fast-paced market like Kenya’s, require a robust system that not only simplifies financial operations but also ensures compliance with local credit policies and industry standards.

Odoo Finance offers a comprehensive solution for AR and AP management, providing Kenyan businesses with tools to streamline collections, reduce payment delays, and maintain healthy cash flow. In this blog, we’ll explore how Odoo’s AR and AP management features can benefit businesses in Kenya.

Streamlining Accounts Receivable for Faster Payments

For Kenyan businesses, managing accounts receivable effectively is critical for maintaining healthy cash flow. Odoo Finance simplifies the process by providing tools that automate the invoicing and payment collection workflows, ensuring businesses receive payments on time.

With Odoo, Kenyan businesses can generate customizable invoices that align with local standards, such as including VAT details or complying with KRA requirements for VAT compliance. The system also allows businesses to set up payment terms that reflect their credit policies, giving customers flexibility while ensuring predictable cash inflows.

In addition to sending invoices, Odoo’s automated follow-up system tracks overdue payments and sends automatic reminders to customers, reducing the need for manual follow-ups. This feature is particularly useful in managing debt collection, as businesses can monitor payment statuses in real time and take appropriate action to minimize bad debts.

Optimizing Accounts Payable for Timely Supplier Payments

On the other side of the ledger, managing accounts payable is essential for maintaining good relationships with suppliers and ensuring the business’s reputation in the market. Odoo Finance offers tools that help Kenyan businesses streamline their supplier payment process, ensuring timely payments and optimizing cash flow.

Odoo allows businesses to track supplier invoices and match them with purchase orders, ensuring accuracy and preventing overpayments. By automating the invoice approval workflow, Kenyan companies can reduce administrative delays and process payments faster. The system also provides insights into upcoming payment deadlines, allowing businesses to prioritize payments and avoid late fees or strained supplier relationships.

Additionally, Odoo enables businesses to set up multi-currency payments, which is particularly helpful for companies that import goods or services from outside Kenya. The system automatically calculates exchange rates and updates the accounts payable records, ensuring that payments are accurate and compliant with local currency regulations.

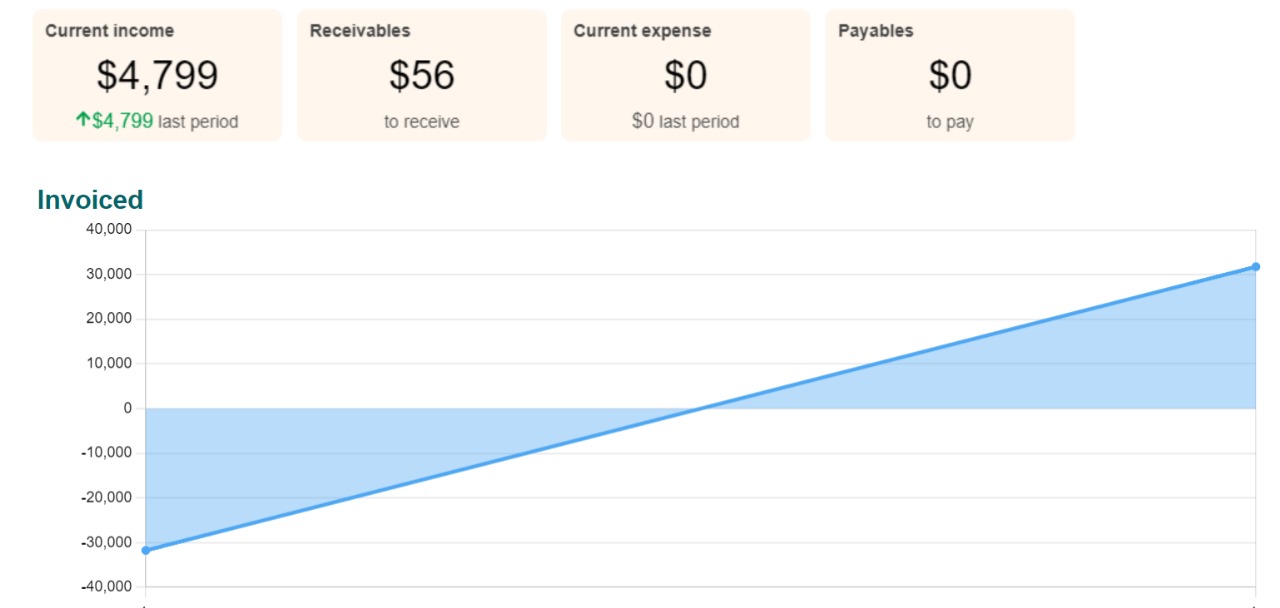

Maintaining a Cash Flow Management System

Cash flow management is a priority for Kenyan businesses, especially in industries with long payment cycles or where businesses extend credit to customers. By optimizing both AR and AP, Odoo Finance helps businesses maintain a healthy cash flow and avoid liquidity issues.

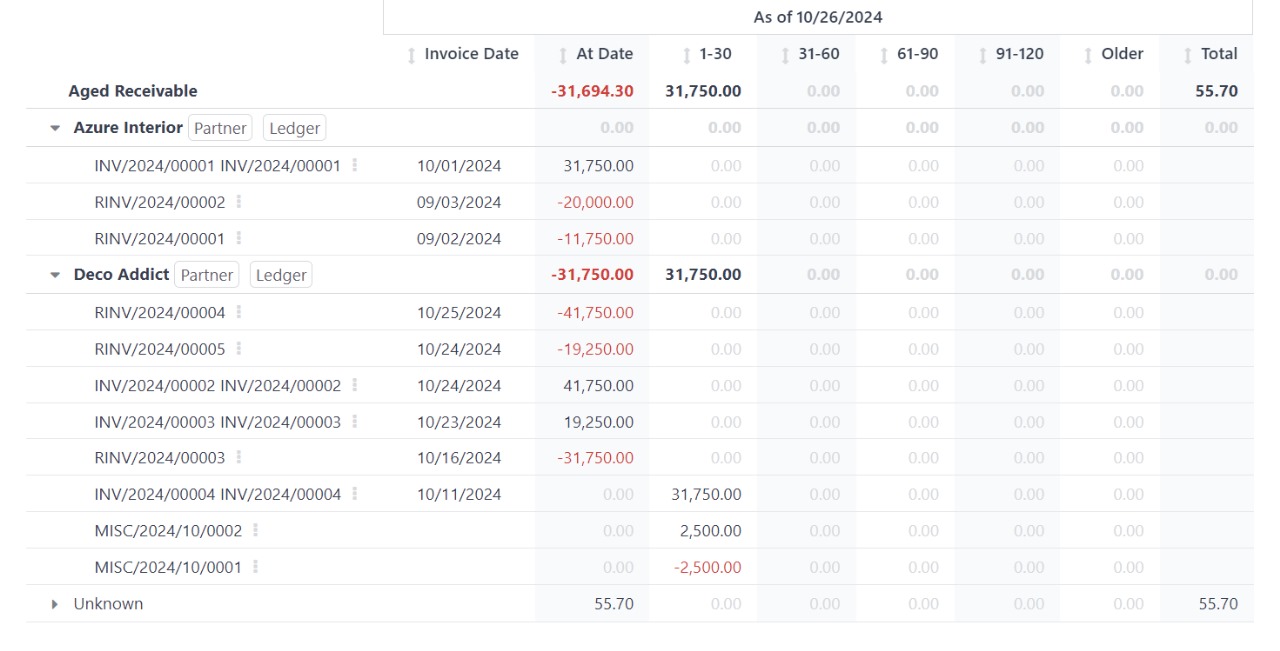

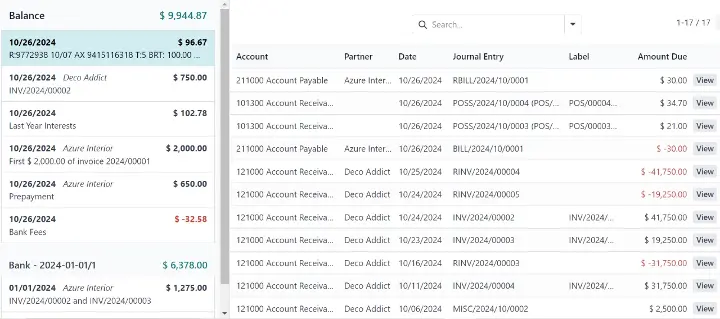

For accounts receivable, businesses can use Odoo to set up payment schedules and monitor customer payment patterns. The system’s comprehensive reporting features provide insights into receivables aging, allowing businesses to identify customers who are habitually late in making payments and take appropriate action, such as adjusting credit terms or offering early payment incentives.

On the accounts payable side, Odoo provides a cash flow forecast that takes into account upcoming supplier payments and expected customer receipts. This feature enables businesses to make informed decisions about when to pay suppliers and when to hold on to cash for operational expenses or investments.

Debt Collection Solutions in Kenya

In Kenya, managing credit policies and handling debt collection can be challenging, particularly for businesses that offer extended payment terms to customers. Odoo Finance offers tools that help Kenyan businesses set and enforce credit policies, ensuring that they minimize the risk of bad debts while maintaining strong customer relationships.

Odoo allows businesses to define credit limits for customers and automatically blocks orders or services if the customer exceeds their credit limit. The system also provides insights into customer payment histories, allowing businesses to assess credit risk more accurately.

When it comes to debt collection, Odoo’s automated reminder system helps businesses follow up with overdue customers, reducing the time and effort required for manual debt collection. The system tracks payment promises and logs customer communications, ensuring that businesses have a complete record of their debt recovery efforts.

Compliance with Local Credit Policies and Practices

Kenyan businesses must adhere to local credit policies and industry practices when managing accounts receivable and payable. Odoo Finance is designed to support these requirements by providing customizable features that align with Kenyan regulations.

For instance, businesses can configure Odoo to include mandatory tax information such as VAT registration numbers on customer invoices. The system also supports compliance with local payment processing requirements, ensuring that businesses can easily handle eTIMS integration for automated tax reporting and compliance with KRA regulations.

Additionally, Odoo’s audit trail feature allows businesses to maintain a complete record of all financial transactions, ensuring transparency and making it easier to conduct internal audits or respond to tax inquiries from the KRA.

Integrated Financial Analytics Solution

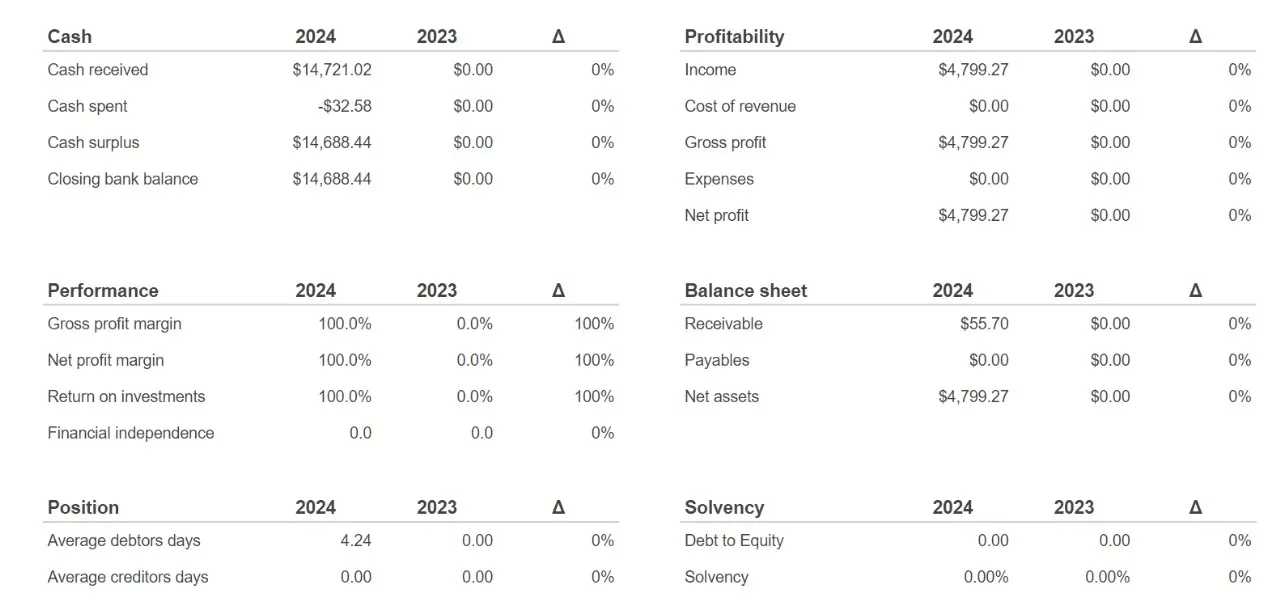

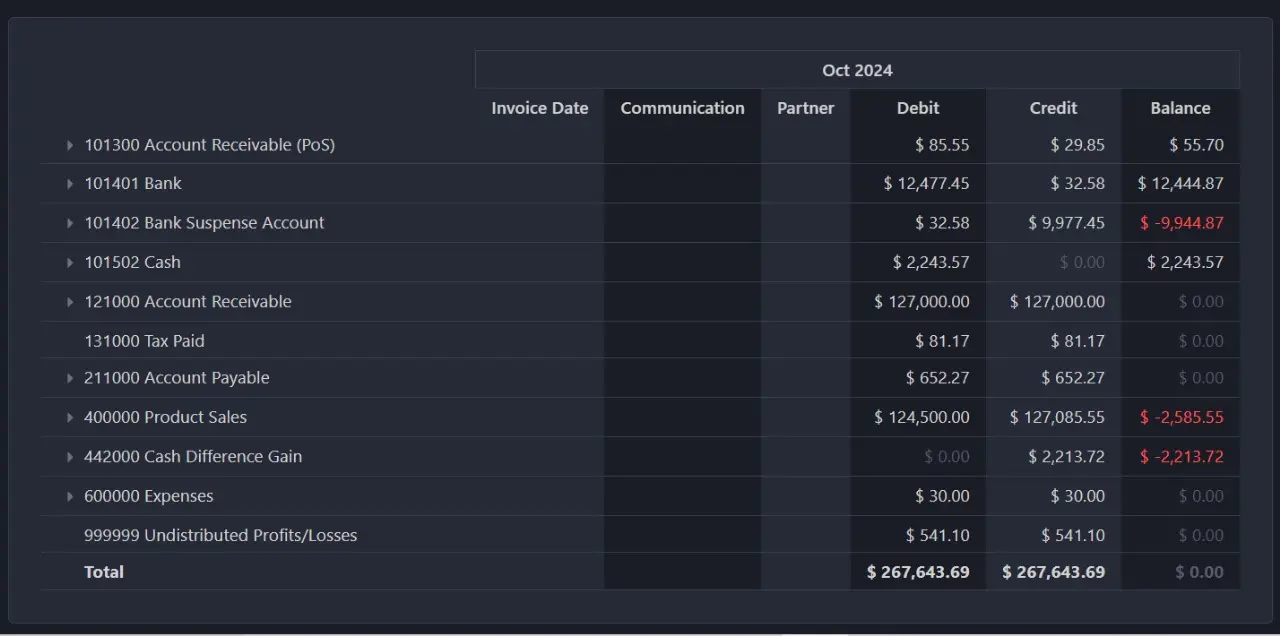

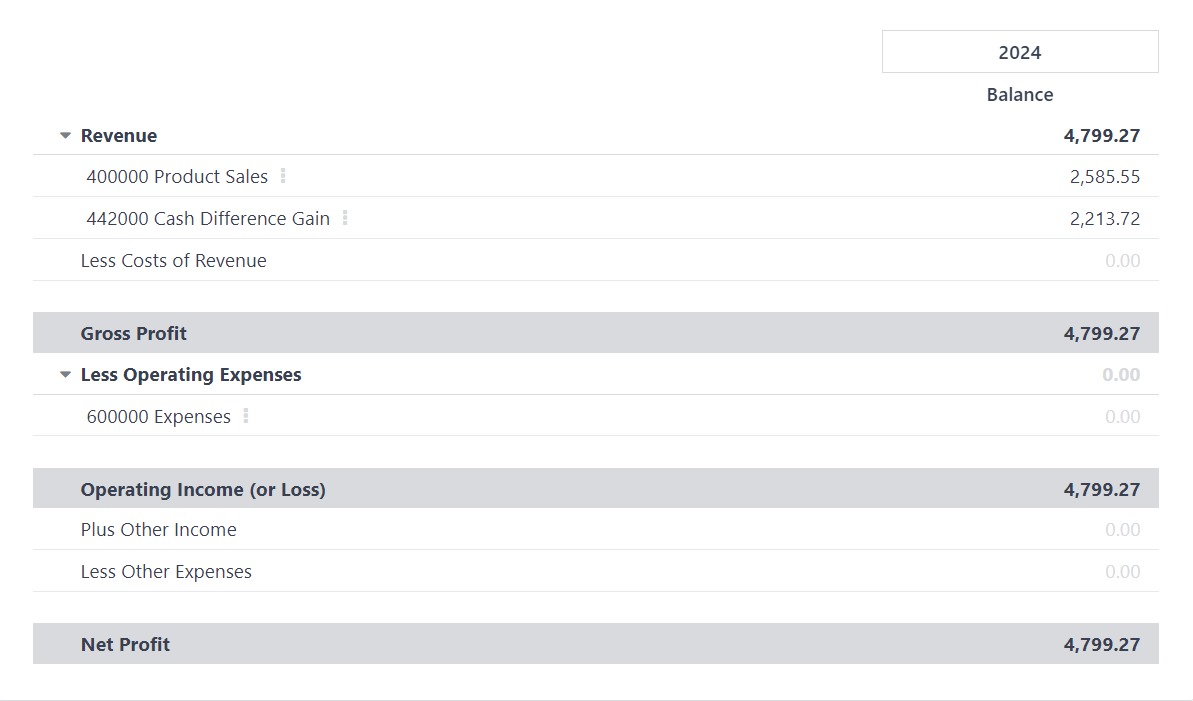

One of the key benefits of using Odoo Finance for accounts receivable and payable management is the ability to generate real-time financial reports that provide insights into the business’s financial health. Businesses can track AR and AP balances, analyze cash flow trends, and generate reports on aging receivables and payables, helping them make data-driven decisions to improve liquidity.

For Kenyan businesses preparing for tax audits or financial reviews, Odoo’s integrated reporting tools make it easy to generate accurate reports that comply with local statutory requirements. This ensures that businesses can provide auditors or tax authorities with the necessary documentation, reducing the risk of penalties or disputes.

Manage Your Accounting With Blackpaw Innovations

Managing accounts receivable and accounts payable is critical for maintaining healthy cash flow and ensuring financial stability in Kenyan businesses. Odoo Finance provides a complete solution for streamlining AR and AP management, helping businesses optimize collections, handle supplier payments efficiently, and maintain compliance with local credit policies.

Looking to transform your business’s financial operations? Blackpaw Innovations is here to help you implement Odoo Finance for seamless AR and AP management. Contact us today for a customized solution!